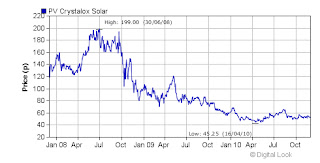

Think again. Looking at the five year share price graph, some shareholders might consider that the Company is so proficient at cleaning that it has managed to clean out their wallets too.

In the past five years, the share price has fallen from a high of 467p in January 2006 to a low of 5p in February 2009.

The current share price of 30p (as at 16 December 2010) gives the company a market value of £75m. Based upon the 2009 basic EPS of 4.7p, this represents a PER of 6.4x.

For the record, my average cost per share is 22p and after dividends equating to 1p per share, my break-even is 21p per share. I am therefore sitting on a paper gain of 41%. I want to understand whether this was luck and/or judgement, and whether I should be topping up or baling out.

Background

JSG is comprised of three main divisions: (i) Textile Rentals (work-wear rentals and laundry services to trade); (ii) Dry-cleaning (Johnsons is the eponymous brand)

The wheels first started to come off in 2006 when the Company experienced IT, stock and local management issues, all of which conspired to generate exceptional costs, write offs and rising debt levels in 2007/8. A new CEO (Skinner) came and went, the 2007 final dividend was cancelled, £30m of new equity was raised through a Placing, Johnson Clothing (the UK's largest provider of corporate clothes was sold off in an MBO for £82m), the shares were transferred to AIM, the debt facilities were refinanced (following a breach of covenants), and John Talbot, an experienced turnaround professional, became CEO. Talk about a boring and uneventful couple of years...

So where are we now? Based upon a review of the 2009 Annual Report, the Company appears to have found a sense of stability. Net debt was down to £68m (less than half of its peak a few years before), the dividend returned (albeit at modest levels), operating cash flow improved, Textile Rentals (with an element of contracted revenues) accounted for 50% of turnover but over 80% of the operating profit in 2009 should help to provide some robustness to earnings.

The Rules

1 - Assets - the net assets on the 2009 balance sheet total £71m compared to a market cap of £75m, which implies that the Company is essentially being valued at book-value. On the face of it, this looks reasonable. However, one must consider the £88m of goodwill sitting on the balance sheet. It is difficult, if not impossible, to know what the true value of a business is (other than what someone is prepared to pay for it), so one cannot say whether this is a 'fair' value or not. At least the net assets are not being valued at a premium above book value.

2 - Market Cap - at £75m it is higher than the £50m floor.

3 - Cash Flow - (a) there are net current liabilities of £9m at December 2009 (v £1m of current assets at December 2008), which is explained partially by £7m of debt repayment now falling due within 12 months and a reduction in trade debtors and other receivables (net of trade creditors); (b) operating cash of £28m (EBITDA of £48m less interest of £7m and 'replacement' capex of £12m) looks good. Out of this, we need to pay the Tax Man (£6m - 2009 P&L), dividends (£1m), and debt repayments (£11m). This leaves £10m for acquisitions, working capital and pension obligations (note the £13m payment to the defined benefit pension scheme in 2009, but it does jump around).

All this leads me to believe that the Company is generating adequate cash for its current needs, but its £60m of future debt repayments (all of which is due to be repaid in the next 5 years) and £20m pension deficit are going to put pressure on any material growth in the size of the dividend in the short-term.

4 - Debt - (a) with net debt of £68m and balance sheet equity of £71m, there is a net debt:equity ratio of 0.95, which is above my target of 0.5 times (ie 50p of debt for every £1 of balance sheet equity), but does not represent ridiculous over-leverage; (b) there is an EV/EBITDA ratio of 4x, based on an EV of £143m and adjusted EBITDA of £36m (less replacement capex). This is at a perfectly reasonable level.

The other point to note about debt is the defined benefit pension deficit. Unlike other debt, where you have certainty over the costs and repayment schedule, pension debt is baffling, not least because it sprawls over five pages in the 2009 Annual Report. Whilst it is a debt obligation insofar as it will snaffle future cash and profit, it jumps around depending on the vagaries of the market and the outlook of actuaries. Because of the variability, I exclude it from the pure definition of debt, but will keep a close eye on it, especially from a cash flow perspective.

5 - PER - a current PER of 6.4x (2009 basic EPS) is conservative and probably reflects the burnt fingers of institutional investors and the AIM listing (unloved and under the radar). No doubt it's tough out there, especially for a company with High St exposure such as Johnsons dry-cleaners, but I am comforted by the contracted revenues of Textile Rentals.

It's easy to get fixated with what the most appropriate measure of EPS should be (basic, diluted adjusted etc), but as a sense check, EBITDA (a proxy for cash profits) for the past four years (2006-2009) comes out at a healthy and reasonably robust £49m, £36m, £44m and £48m respectively, an average of £44m pa.

6 - Yield - the 2009 DPS was 0.75p, representing a yield of 2.5% based on the current price. This is beneath my target yield of 3.5%. Based on 2009 basic EPS of 4.7p, the dividend is covered a healthy 6 times, suggesting that there is scope to increase the dividend, although probably not too much in the short-term given that cash will be used for working capital and debt repayment.

7 - ROE - the 2009 ROE was 12.7% and is greater than the 10% target.

8 - Directors - the eight directors hold 5.6m shares directly (value of £1.7m), and of these the CEO (Talbot) has 3.8m (£1.1m). Stripping the CEO out, the other directors hold on average c250,000 shares each (£75k), which is a little on the low side. In addition there are an additional 14m share options/LTIPs kicking around, which provide an extra incentive for the directors to improve the share price. In general, the director remuneration looks reasonable for a company of this size.

Post-scipt: the directors added another 2.7m shares in September, following the release of the interims, which takes their direct holding to 8.3m (£2.5m).

9/10 - Buy or Bye? At this stage, I would wish to examine the 10 year record to see how the company is valued in the context of long-term earnings and valuation multiples. Clearly, the Company going into 2011, is in a very different shape to the one that thrived and (just about) survived throughout the last decade, rendering any comparison as troublesome.

The 10 year basic EPS average is 3.4p, although if you strip out 2007 and 2008, it jumps to 23.7p! The average PER is 9.0x, although if you strip out 2007 and 2008 again, it jumps to about 11.2x (albeit on the Main Market).

Recent Developments

In the interims (6 months to June 2010; released in September 2010), the CEO announced progress in line with expectations. Turnover was under pressure, margins held up, net debt had fallen to £65m, but the pension deficit was up, an increased interim dividend (up 8% - or a mighty 0.02p!) and an opportunistic acquisition of some PFI contracts from the remnants of Jarvis. All in all, steady progress, with a focus on cost control (if not reduction), cash generation and revenue protection.

Conclusion

In terms of valuation, I propose that a current EPS of 4.7p feels about right (=£11.5m PAT), but a slightly higher multiple should be reasonable, at say 9x. This gives a target sale price of 42p. If JSG reaches this price by Christmas 2012, I will have generated a return of c100% and an IRR of 25-50% depending on how quickly we get there.

Whilst a jump from 30p to 42p sounds high, the shares have had some momentum recently, climbing from 16p to 30p in the space of 6 months. The directors acquired 2.7m shares in September, which must have helped to stimulate matters.

But should I buy some more given that I believe a further 50% upside is achievable? If the yield was a bit higher, the debt a bit lower and there was a bigger discount to net assets, it would be a screaming buy. However, given my relatively low entry point, I find it difficult to add new shares at a much higher base cost. Maybe it's a psychological thing, or maybe I want to keep my powder dry for other investment opportunities that offer a bigger perceived discount, but in the meantime, I'm going to HOLD, with a TARGET SALE PRICE OF 42p. I will review my analysis when the 2010 final results are published, as a solid set of results, may act as a trigger for a re-rating.