I don't like losses any more than I like sun-stroke, so now is the time to evaluate (a) whether I should have bought the shares in the first place (based on my new rules) and (b) whether to buy, hold or sell.

Background

PVCS doesn't adhere easily to the mantra of 'only invest in companies that you understand'.

Big picture: the world's energy requirements are increasing (more people, more middle-classes, more technology etc), the 'dirty' energy sources are neither green nor politically correct (unless you're a Texan), and are expected to run-out eventually, meaning that the gap needs to be filled. I quite like this graphic from the PVCS web-site, which sums it up neatly, although may not be totally unbiased.

There is a dynamic between the point at which the 'dirty' energy sources start hitting a down-ward trend (about 2030 according to this graph) and which alternative energy source will come to dominate thereafter. Solar power is purported to be the answer, according to this graph at least.

So, where does PVCS come into it? For a more detailed explanation, see the website - http://www.pvcrystaloxsolar.com/PhotovoltaicEffect.html ...but in essence PVCS manufactures silicon-based photovaltic cells which convert the suns rays into energy.

There are various stages to the production process/supply chain, but PVCS concentrates on manufacturing the ingots and wafers in the UK and Germany, and making wafers and selling through an operation in Japan.

The Company was founded in 1982 and listed in 2007, raising Euros 73m to help build the new plant in Germany (moving down the supply chain to secure solar grade silicon supplies). Key attractions in the Prospectus included: the IP to produce 'wafer-thin'...er...wafers, and long-standing relationships with the big Japanese boys, although the top three suppliers did account for 73% of sales at time of listing.

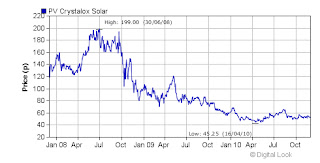

So, what has happened since the listing? The German factory has opened and is scaling up to full capacity in 2011, but that has happened against a back-drop of over-supply in all parts of the value chain, which has caused prices to plummet by up to 40%, and there are question-marks over the level and longevity of government subsidies (particularly in Spain, but offset by growth in Germany (higher volumes, lower prices) and Japan). Unsurprisingly, the share price has been heading in one direction only; like a sun-set.

|

| Source: Digital Look, from PVCS website |

The shares traded within a whisker of 200p in July 2008 and fell as low as 45p in April 2010. Based on the current price of 53p, the Company has a market cap of £222m, which represents a PER of 8.8 times 2009 basic EPS of 7.2 cents (= 6p). A low PER is the starting point for a bargain share, so let's have a look at the rest ...

The Rules

Based on the accounts for year to December 2009 and assuming I can get Euros 1.2 for my £...

1 - Assets - shareholders equity of £216m on the balance sheet versus a market cap of £222m. Assets valued at par; hurrah. Of the net assets, £100m is in relation to tangible assets (property, plant & equipment) and a very small monetary value is attributed to the goodwill (patents and software). I'll come on to working capital and debt in later sections, but at this stage, am comforted by the sensible market cap in relation to the net assets. A discount would have been nice, but let's not get greedy...

2 - Market cap - greater than £50m. Job done.

3 - Cash flow

(a) balance sheet: current assets less current liabilities = +£125m, looks very healthy. No problems in being able to meet short-term obligations, especially given the net cash position of £+58m.

Better still, there is (almost) enough cash in the bank to meet all liabilities: current and long-term. This favourable position has persisted for the last three years, although is unwinding as the Company has taken on more debt and invested in the building of the factory. It is worth noting that in the last three years, the Company has received grants and subsidies of £19m, which has helped to contribute towards the £71m cost of the German facility.

(b) operating cash: operating cash after working capital movements and interest was £36m, but out of this, we need to pay the tax bill (£33m - high due to bumper profits in 2008), before even thinking about capex and dividends (£20m). If we 'normalise' (I hate that word) the tax figure with the 2010 P&L charge (£11m), we come up with an adjusted operating cash figure of £25m, which helps to cover the dividends. That gets me reasonably comfortable that the Company generated sufficient operating cash in 2010 to support the dividend payment. I have conveniently ignored replacement capex as there is too much going on with the new factory to get a feel for what is replacement and what is required to support future growth.

Below operating cash, the cash flows jump around with increasing capex, offset by grants, new bank debt and forex movements.

4 - Debt

(a) gearing - there is cash on the balance sheet of £83m and debt of £25m, resulting in a net cash position of £58m. The debt has jumped around a bit, but since the refinancing in 2009 with Sumitomo

(b) EV/EBITDA - an EV of £164m (£222m-£58m) versus 2010 EBITDA of £44m, results in a ratio of 3.7x, which is very reasonable. It looks even more reasonable if one takes the average EBITDA of the past three years (£77m), resulting in 2.1x.

5 - PER - 2009 basic EPS was 6p per share, which generates a current PER of 8.8x. Ideally, we would want a 10 year EPS to test, but the Company has been listed for three years only, and due to a bumper 2008, average EPS increases to 13.2p per share, bringing PER down to 4x. There are profit figures contained in the listing Prospectus but these were generated under a different capital structure and therefore are not directly comparable. For interest, if we include these, we get a 6 year average EPS of 7.7p, which results in a PER of 7x.

For the purpose of this valuation, I will suggest that we are trading on a PER of 7-9x, which gets us into value territory.

Whilst 2008 was a good year, it looks particularly good from a comparison point of view with 2009, as profits were inflated by a net £37m currency benefit and a lower depreciation in 2008. This shows the perils in looking purely at a basic EPS calculation. However, ongoing margin pressure and increasing depreciation will put further downward pressure on EPS, and will help to prolong any potential re-rating in the market. The new borrowings in Yen should provide a natural hedge, and help to stabilise these currency swings a bit.

6 - Yield - the 2009 DPS was 2p, which results in a yield of 3.1% and is as about as low as I'd like to go. The dividend has jumped around dependent upon earnings, but has averaged around 3.7p over the past three years, which would represent a yield of 5.9% based on current price. A note of caution though as the 2010 interim has been halved, which means that the level of dividend is under threat in the short-term.

On the plus side, there is plenty of earnings cover and cash to support payment of future dividends. The 2009 Annual Report makes reference to resuming a progressive dividend policy when conditions allow, which is comforting.

7 - ROE - the average ROE for the last three years is a healthy 26%, which ticks the box. Again, a longer time-frame is required to give a real level of confidence, given that this period covered a boom year in 2008.

8 - Directors - although the directors take nice salaries and bonuses, they still have a hefty investment in shares (largely due to owning a big slug at the time of IPO). The CEO has 44m shares (£23m) and the other directors hold 12m shares (£6m), which leads me to believe that they have enough skin in the game to act in the best interests of all shareholders. Given the size of these large holdings, there is little evidence of director buying, but they can be forgiven for that.

9/10 - Buy or Bye? A three year EPS of 13.2p and a three year-rating of 8.2x (courtesy of Sharelockholmes) gives us a (not very) long-term 'fair' price of 108p.

This is heavily caveated by the short trading history as a listed company, exceptional profits in 2008 and an evolving market.

Recent Trading

The 2010 interims (September 2010) were mixed but the Interim Management Statement (November 2010) was a bit more bullish. Higher volumes and stable prices were positive, but revenues were flat v H1 2009, margins were down, EBITDA down 40% and the interim dividend was halved. On the balance sheet, cash has gone up, net current assets has gone up and net assets have increased (meaning that the market value is now at a discount to net assets), although currency fluctuations have helped. Chinese, Japanese and Taiwanese markets are growing, which should help volumes to continue growing.

Conclusion

After all that, my head hurts. My take on it is that the market probably over-valued the share (mini techno bubble) in 2008 and is now more circumspect about future prospects, probably under-valuing the Company, having been "bitten once, twice shy".

From a valuation perspective, I like this share. Slight discount to net assets, earnings multiples not expensive, lots of cash kicking around, good return on equity, high director stake and a dividend.

What I don't like about this Company is that earnings have jumped around so much in its short history, which is a reflection of the vagaries of an evolving technology in an evolving market in an evolving world. Green is "in", but requires lots of subsidies to make it work, and current growth appears to be fuelled by the Asian economies, but what happens if they slow down? There is also a battle to be had between which alternative energy supply will come to dominate, although that battle might be a way off, and which technology will come out on top within solar.

If I came across this Company anew, I would probably hold-fire on a new investment, purely because of the lack of long-term trading history on the ability to generate long-term sustainable profits, and the sectoral issues that need to play themselves out. I can rationalise why I bought the share in the first place, albeit without the assistance of some rules to test, with evidence of a low valuation and lots of cash sloshing around.

If I am going to hit my aspirations of a 15% IRR, I need the price to hit 110p by December 2013 (assuming a three year window and a 2p dividend per annum) from my current starting point. A price of 110p is well within the range considering the all-time high and would represent an EPS of 12p on a PER of 9x, both of which should be achievable, although a modest re-rating would certainly help. Interestingly, this is within a whisker of my caveated fair price of 108p above.

In the absence of further information, I am going to HOLD, with a price target of 110p. If the price drops below 50p, I will consider topping up.

The sun is shining for now.

If I came across this Company anew, I would probably hold-fire on a new investment, purely because of the lack of long-term trading history on the ability to generate long-term sustainable profits, and the sectoral issues that need to play themselves out. I can rationalise why I bought the share in the first place, albeit without the assistance of some rules to test, with evidence of a low valuation and lots of cash sloshing around.

If I am going to hit my aspirations of a 15% IRR, I need the price to hit 110p by December 2013 (assuming a three year window and a 2p dividend per annum) from my current starting point. A price of 110p is well within the range considering the all-time high and would represent an EPS of 12p on a PER of 9x, both of which should be achievable, although a modest re-rating would certainly help. Interestingly, this is within a whisker of my caveated fair price of 108p above.

In the absence of further information, I am going to HOLD, with a price target of 110p. If the price drops below 50p, I will consider topping up.

The sun is shining for now.

Yorkiem, this is good stuff and far more detailed than some of the research I've been doing. I bought into PVCS at 118 and bailed out low enough on the downturn to lose a lot of cash. However I agree that green energy will be a success and, for me, solar has the huge advantage in that (unlike wind and wave) there are no moving parts. The day that someone is bright enough to manufacture solar panel roof tiles is the day solar will take off. There must be billions of roof tiles just waiting to be renewed....

ReplyDeleteStay with it

Hi there,

ReplyDeleteI agree with this analysis far more than any other from a broker or in the press. I watched PVCS for a while and averaged in at 56p, so allowing for the divi I only have a slight loss. Any drop below 50p is very definitely a buy, but you do need to take at least a medium term outlook for PVCS as no one can predict the price of oil and gas or the political antics of the subsidies game. Like many EU based companies it also reacts badly to trouble with the PIGIS although PVCS are well leveraged in currency terms.

Regards JB ( www.hybridairship.net )

Thanks Malcolm. Love the idea of solar panel roof tiles - get yourself on Dragon's Den!

ReplyDeleteHi James. I set my a three year target of 110p to give me some degree of comfort that there is a fighting chance of generating my target return given my starting point.

ReplyDeleteI intend to do an annual review (at least) to decide whether I should buy/hold/sell. In the meantime, if it drops a bit more, I shall buy